Multi Factor investing is an investment strategy that involves targeting specific characteristics or “factors” in stocks or other assets that are believed to drive their returns. Factors can include characteristics such as value, momentum, size, quality, volatility, and dividend yield.

- The idea behind multi factor investing is that these characteristics have historically been associated with higher returns or lower risk, and by targeting them, investors can potentially outperform the market or achieve specific investment objectives.

- Factors can be either macroeconomic or stock-specific: Macroeconomic factors include variables such as interest rates, inflation, or economic growth. Stock-specific factors include variables such as price-to-earnings ratios, dividend yields, or volatility.

- Factor-based strategies can be active or passive: Factor investing strategies can be implemented through active management, where fund managers use their discretion to select stocks that exhibit desired factor characteristics. Alternatively, factor-based investing can also be done through passive strategies, such as index funds that track specific factor-based indexes.

- Different factors work better in different market conditions: Different factors tend to perform better in different market conditions. For example, value factors tend to perform better during periods of economic recession, while momentum factors tend to perform better during periods of economic expansion.

- Factor investing can be used for diversification: By investing in factors that are not highly correlated with one another, investors can achieve greater diversification and potentially reduce portfolio risk.

- Factor investing is not a guaranteed strategy: While factor investing can potentially generate excess returns, it is not a guaranteed strategy. Factors can experience prolonged periods of underperformance, and investors need to be prepared for this possibility.

- For example, a value-focused factor strategy would involve selecting stocks that are deemed undervalued based on metrics such as price-to-earnings ratios, price-to-book ratios, or dividend yields. A momentum-focused factor strategy would involve selecting stocks that have exhibited strong recent price performance.

- Factor investing can be implemented through a variety of approaches, including actively managed funds, passive index funds, or custom-built portfolios. The approach taken will depend on the investor’s goals, risk tolerance, and investment philosophy.

In summary, factor investing is an investment strategy that involves targeting specific characteristics or factors in stocks or other assets that are believed to drive their returns. By doing so, investors aim to potentially outperform the market or achieve specific investment objectives.

Who has developed Multi Factor investing theory

- Multi-factor investing is a strategy that has been developed and refined by many researchers and practitioners over the years. Some of the earliest work on the topic can be traced back to Nobel laureate Eugene Fama and his colleague Kenneth French, who proposed the Three-Factor Model in 1993.

- Since then, many other researchers have contributed to the development of multi-factor models, including Andrew Ang, Robert Novy-Marx, Clifford Asness, and David Blitz, among others.

- Today, many investment firms offer multi-factor investment strategies, and the approach has gained popularity among investors seeking to enhance returns and reduce risk.

What are the benefits of Multi Factor Investing

Multi-factor investing has several potential benefits for investors, including:

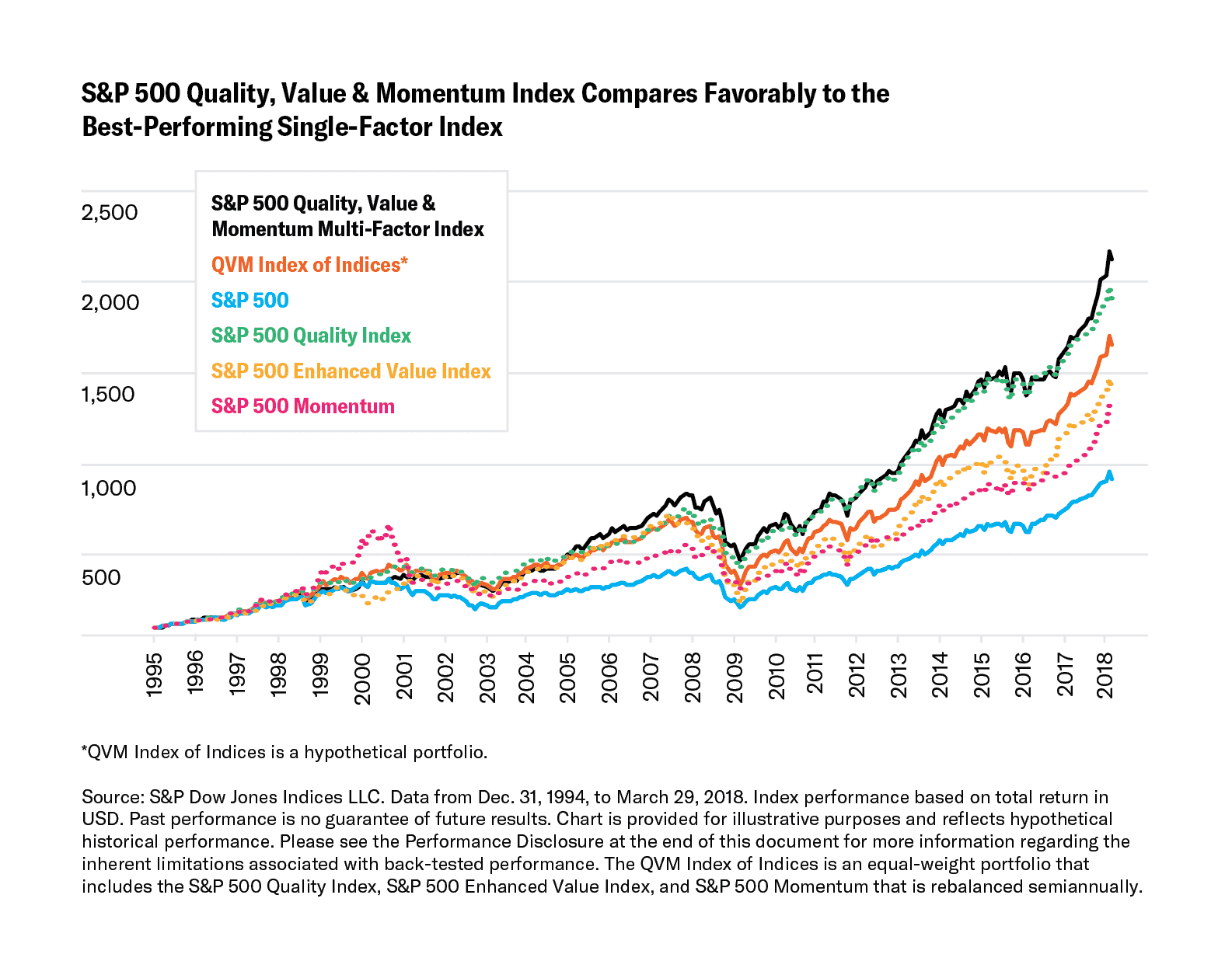

Enhanced returns: By diversifying across multiple factors, the strategy has the potential to capture a broader set of risk premia, which can lead to higher returns over the long term.

Reduced risk: By diversifying across multiple factors, the strategy aims to reduce the risk of relying on any single factor. This can make the portfolio more resilient to market downturns and potentially lead to lower volatility.

Improved diversification: By using a variety of factors, the strategy can provide exposure to different sources of risk and return, which can improve the overall diversification of the portfolio.

Reduced dependence on market cap-weighted indices: Multi-factor investing allows investors to move away from the traditional market-cap weighted approach, which can be heavily concentrated in a few large companies and sectors.

Customization: Multi-factor investing allows investors to customize their portfolios based on their specific risk and return objectives, as well as their views on different factors.

Overall, multi-factor investing can be a powerful tool for investors seeking to enhance returns and reduce risk, while also improving diversification and customization.

What are the drawbacks of Multi Factor Investing

Multi-factor investing refers to a strategy that combines several factors, such as value, momentum, quality, and low volatility, to construct a portfolio. While this approach has gained popularity in recent years, there are some drawbacks to consider:

Complexity: Multi-factor investing can be complex and require significant expertise to implement effectively. Investors need to understand each factor and its interaction with other factors in the portfolio.

Higher Costs: Implementing a multi-factor strategy can be more expensive than a traditional passive index approach. The costs of researching and managing the portfolio, as well as trading fees, can add up.

Overlap: There can be overlap between factors, which can lead to unintended concentration or exposure to certain sectors or stocks. This can reduce diversification and increase risk.

Market Cycles: Multi-factor strategies may underperform during certain market cycles or in specific market conditions. For example, if value factors are out of favor for an extended period, a portfolio heavily weighted towards value could experience prolonged underperformance.

Behavioral Biases: Investors may be influenced by behavioral biases, such as recency bias or overconfidence, when selecting and weighting factors in the portfolio.

Lack of Transparency: Multi-factor strategies can lack transparency, making it difficult for investors to understand the exact holdings and factors driving performance.

It’s important to note that these drawbacks are not unique to multi-factor investing and can apply to any investment strategy. Investors should carefully consider their goals, risk tolerance, and investment horizon before implementing any investment strategy.

Read More:

Terry Smith, Investing for Growth Book Summary

John Bogle, The Little Book of Common Sense Investing Book Summary