Pre-requisites for success in trading

Trading is one of the most popular and lucrative ways of making money in today’s world. However, many people fail to make consistent income from trading because they don’t follow trading discipline and have unrealistic return expectations. They trade based on latest fad or whatever they hear in financial or social media which eventually leads to losses and a dead-end. To be good at trading, one needs to have a robust,back-tested trading strategy, have well-defined rules on risk management and position size. If one has these three things in place, then there is absolutely no reason why one cannot generate consistent returns from the markets. Also, one should ideally focus on a couple of instruments and understand their price action and patterns better to increase their odds of success. In this article, I will discuss the best SPX trading strategy for 2023.

Best SPX Trading Strategy

The best SPX trading strategy in my years of research and experience is trend following. The reason trend following strategies are the best is because one doesn’t need to predict what will happen next. One just rides the trend as long as it is motion and exits or reverses the position when the trend has changed. The basic construct of trend following is to ‘buy high and sell higher’ and vice-versa. Some of the most common trend-following systems are based on moving averages, Dow-theory etc. In this article, I will demonstrate the same with a very simple trend following system to show it’s potential. We will see how the strategy performed in 2022 when SPX corrected by more than 20%. The trend following strategy or system which we are going to discuss for the purpose of this article is Supertrend.

Brief about the trading system

Supertrend indicator was developed by a trader named Olivier Seban. The indicator works across different time frames and asset classes. Generally, It is used on hourly and daily charts. Based on the parameters of multiplier and period, the indicator uses 3 for multiplier and 7 for ATR as default values. Average True Range is represented by the number of days while the multiplier is the value by which the range is multiplied. We would be using the default setting as suggested by Olivier for testing our trend following strategy. This indicator is available across all free charting portals like Tradingview.com or Investing.com.

How to implement the strategy

As per this trading strategy, we when the indicator is green, one has to keep a long position i.e. long SPX futures contract and when the indicator is red has to run a short position i.e. short SPX futures contract. As can be seen in the below image, when the indicator is green, one has to keep a long position and when the indicator is red has to run a short position. This can be easily done by trading the SPX futures contract.

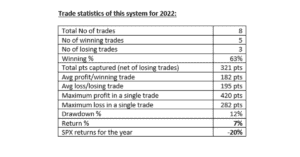

As can be seen above, this simple system would have made 7%+ returns in a year when SPX fell by more than 20%. This system has outperformed the index by a substantial margin every single year for which SPX has traded. The purpose of this short article is not to share some trading system or strategy but to make one think the potential of trend following.

Final Thoughts

I have demonstrated the power of systematic trend following with the help of a simple system. Trend following is the best strategy for generating consistent market beating returns. Trend following systems might give drawdown during choppy market conditions or when market trades in a range, but it eventually makes up more than that once the market gets out a range.

Thanks for reading. Please get in touch in case of any queries or feedback.