John Clifton Bogle, commonly known as Jack Bogle, was an American investor and businessman who founded the Vanguard Group and was credited with revolutionizing the mutual fund industry. He was born on May 8, 1929, in Verona, New Jersey, and passed away on January 16, 2019, in Pennsylvania.

John Bogle Early Life

John Bogle was raised in a financially stable family and attended Blair Academy, a prestigious boarding school in New Jersey. He later attended Princeton University, where he earned a degree in economics in 1951.After graduation, Bogle started his career in the investment industry, working for several firms, including Wellington Management Company.

John Bogle Professional Career

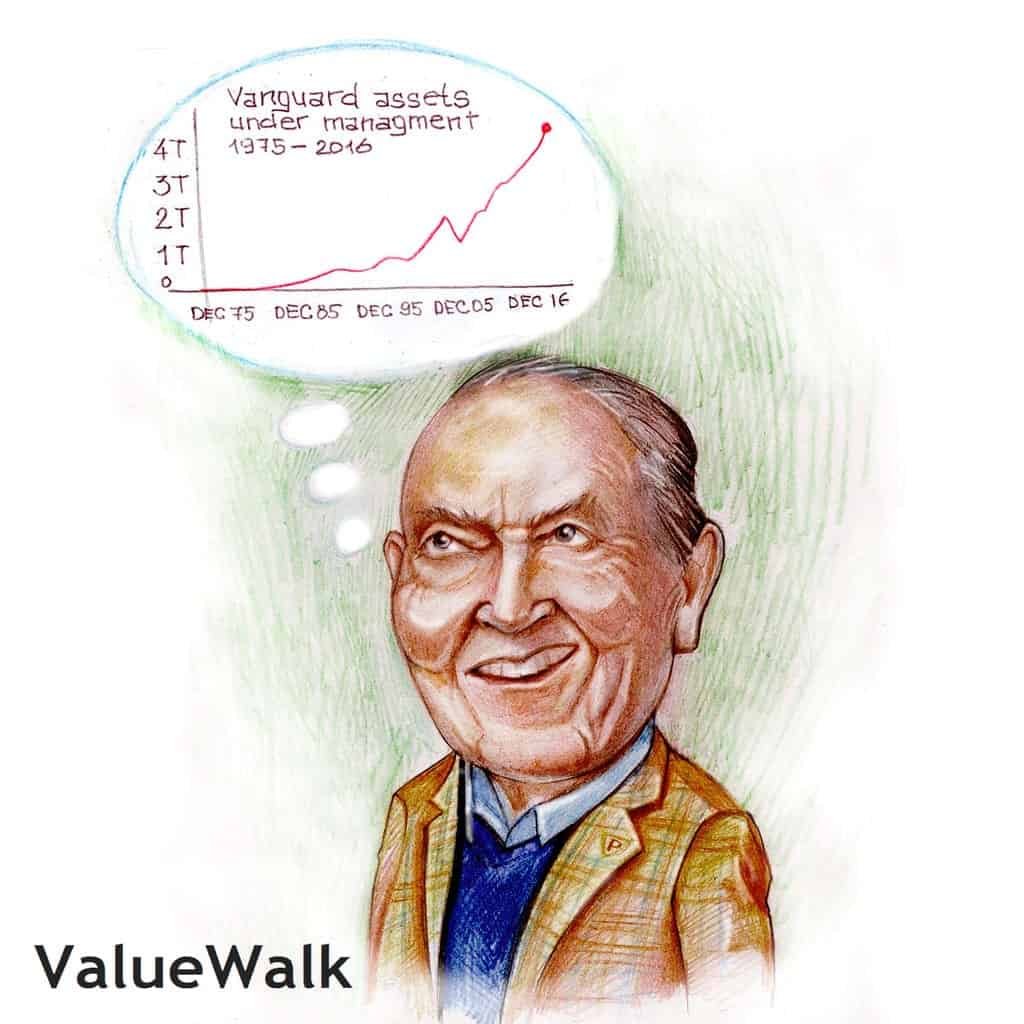

In 1974, John Bogle founded the Vanguard Group, which is now one of the world's largest investment management companies. Vanguard is known for its low-cost index funds and has been praised for its customer-centric approach to investing. Bogle served as Vanguard’s CEO until 1996 and continued to serve as its senior chairman until 2000. Throughout his career, Bogle was a strong advocate for low-cost, passive investing and was critical of high fees charged by active fund managers. He authored several books on investing, including ‘The Little Book of Common Sense Investing’ and ‘Enough: True Measures of Money ,Business, and Life’.

John Bogle Personal life

John Bogle was also known for his philanthropic work. He founded the Bogle Financial Markets Research Center and was a member of the board of trustees for Blair Academy and the National Constitution Center. In 1999, he was awarded the Woodrow Wilson Award for Corporate Citizenship. Bogle was married twice and had six children. He suffered several heart attacks throughout his life and underwent a heart transplant in 1996. Despite his health challenges, he remained active in the investment industry until his death in 2019 at the age of 89. In this article, we discuss key takeaways from the book ‘The Little Book of Common Sense Investing’.

John Bogle Quotes

• The greatest enemy of a good plan is the dream of a perfect plan.

• Time is your friend; impulse is your enemy.

• Don’t look for the needle in the haystack. Just buy the haystack!

• In investing, you get what you don’t pay for.

• If you’re excited about your investments, it’s probably time to sell.

• The stock market is a giant distraction to the business of investing.

• The mutual fund industry is like the hotel industry – they charge you for the mini-bar.

• When reward is at its pinnacle, risk is near at hand.

• If you’re going to invest at all, common stocks are the way to go.

• The difference between the return on capital and the cost of capital is the holy grail of investing.

John Bogle Books:

John Bogle wrote several books throughout his career. Here are some of his most notable books:

Bogle on Mutual Funds: New Perspectives for the Intelligent Investor” (1993): This book is considered a classic in the mutual fund industry and provides a comprehensive overview of mutual fund investing.

Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor” (1999): In this book, Bogle emphasizes the importance of low-cost, passive investing and provides practical advice on how to build a diversified investment portfolio.

The Little Book of Common Sense Investing: This book is a concise guide to investing in low-cost index funds and is widely regarded as a must-read for individual investors.

The Clash of the Cultures, Investment vs. Speculation: This book examines the financial industry and the challenges it faces in balancing the interests of investors and speculators.

Stay the Course, The Story of Vanguard and the Index Revolution: In this book, Bogle provides an insider’s perspective on the founding and growth of Vanguard Group, and how it transformed the investment industry with its low-cost index funds.

Overall, Bogle’s books provide valuable insights into investing, personal finance, and the financial industry. His writing style is clear, concise, and accessible, making his books accessible to both novice and experienced investors alike.

Key Takeaways/Summary of book The Little Book of Common Sense Investing:

The Little Book of Common Sense Investing was published in 2007 and has since become a classic in the field of investing.

The book’s main argument is that the best way to invest is to focus on low-cost, passive index funds rather than trying to pick individual stocks or actively managed mutual funds. Bogle argues that active management is usually not worth the higher fees that come with it and that most investors would be better off sticking to a simple, low-cost approach.

The book is divided into three parts. The first part outlines the case for passive investing, explaining why trying to beat the market through active management is usually a losing proposition. Bogle argues that markets are generally efficient and that trying to outsmart them through active management is difficult if not impossible.

The second part of the book focuses on the benefits of index funds. Bogle explains how index funds are designed to track a specific market or benchmark, and how they offer investors broad diversification at low cost. He also provides a brief history of the development of index funds, highlighting the role that he played in their creation.

The final part of the book provides practical advice for investors. Bogle emphasizes the importance of keeping costs low and avoiding high fees, and provides guidance on how to construct a simple, low-cost portfolio using index funds. He also provides tips on how to stay disciplined and avoid the temptation to make rash decisions based on short-term market fluctuations.

Overall, ‘The Little Book of Common Sense Investing’ is a highly accessible and practical guide to investing for both novice and experienced investors. It provides a compelling argument for the benefits of passive investing and offers clear guidance on how to implement a low-cost, diversified portfolio. The book is a valuable resource for investors seeking to build a low-cost, diversified portfolio that can provide steady, long-term investment returns. The book’s straightforward and easy-to-understand language makes it accessible to both novice and experienced investors alike.

Read More:

Terry Smith, Investing for Growth Book Summary

Joel Greenblatt, The Little Book That Beats The Market Summary