Introduction

Monish Pabrai, a prominent figure in the world of finance, is widely recognized for his expertise in value investing and his success as a fund manager. Born in 1964 in Mumbai, India, Pabrai’s journey from a small-town upbringing to becoming a globally acclaimed investor is a testament to his intelligence, discipline, and unwavering commitment to the principles of value investing.

In the world of finance and investment, Monish Pabrai stands as a beacon of inspiration, known for his astute business acumen and investment prowess.Monish Pabrai’s early years were marked by a curious intellect and a drive for knowledge. Raised in a middle-class family, he displayed an early affinity for numbers and finance. Pabrai’s formative years in Mumbai laid the foundation for his future success, as he absorbed the nuances of the financial world while navigating the bustling streets of the city.

Personal Life

Pabrai’s early life in Mumbai laid the foundation for his future success. He earned his bachelor’s degree in computer engineering from Clemson University in the United States, where he developed a keen interest in finance. Pabrai’s ability to combine his technical background with financial acumen set the stage for his unique approach to investing.

Beyond his investment successes, Pabrai is recognized for his philanthropic efforts. The Dakshana Foundation, co-founded by Pabrai, focuses on providing quality education to economically disadvantaged students in India, exemplifying his commitment to giving back.

Professional Life and Career

Monish Pabrai’s professional journey took a significant turn when he founded his investment firm, Pabrai Investment Funds, in 1999. His investment philosophy, heavily influenced by Warren Buffett and Charlie Munger, revolves around the concept of “Dhando” a term in Gujarati that translates to “endeavors that create wealth”. Pabrai”s career soared as he consistently outperformed the market,

attracting attention for his shrewd investment decisions and ability to identify undervalued stocks.

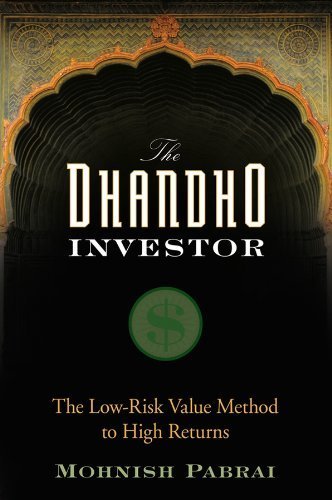

The Dhando Investor

In his book ‘The Dhando Investor: The Low-Risk Value Method to High Returns” Monish Pabrai shares his insights into the world of value investing. The book serves as a guide for both novice and seasoned investors, offering a simple yet powerful approach to making successful investment decisions. Let’s delve into the key takeaways from this influential work:

Focus on Low-Risk, High-Uncertainty Investments

Pabrai emphasizes the importance of seeking investments where the downside is limited while the upside is substantial. By focusing on opportunities with low risk and high uncertainty, investors can position themselves for attractive returns.

Invest in Simple Businesses

The Dhando approach encourages investors to understand the businesses they invest in thoroughly. Pabrai advocates for investing in simple, easy-to-understand businesses with a competitive advantage, as they are more likely to maintain a consistent and predictable performance.

Margin of Safety

Pabrai, like many successful value investors, stresses the significance of a margin of safety. This involves buying stocks at a significant discount to their intrinsic value, providing a buffer against unforeseen risks and market fluctuations.

Bet Big on Convictions

The Dhando philosophy encourages investors to concentrate their investments in a few carefully selected opportunities. Pabrai believes that placing substantial bets on high-conviction ideas can lead to outsized returns when those investments perform well.

Be Patient and Long-Term Oriented

Pabrai advises investors to adopt a patient, long-term perspective. Successful investing, according to him, requires the ability to withstand short-term market volatility and stay focused on the fundamental value of the investments.

Conclusion

Monish Pabrai’s journey from a small Indian town to a globally renowned investor is a testament to the power of disciplined value investing. Through his firm Pabrai Investment Funds and his book “The Dhando Investor,” he has shared valuable insights that continue to inspire and guide investors worldwide. Pabrai’s emphasis on simplicity, risk management, and patience serves as a timeless

blueprint for those seeking success in the complex world of finance. Aspiring investors can undoubtedly draw inspiration from Pabrai’s life and principles to navigate the markets and build lasting wealth.

Read More: