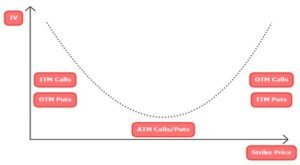

Options Vanna

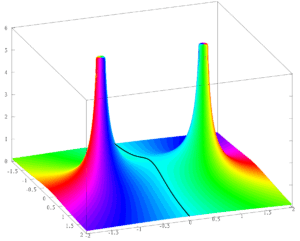

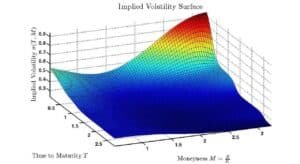

Options Vanna is a second-order derivative of the option price with respect to changes in the underlying asset’s implied volatility. It measures the sensitivity of the option’s delta to changes in the underlying asset’s implied volatility. • In other words, Options …