Peter Lynch was born on January 19, 1944, in Newton, Massachusetts. He is best known for his successful career as a portfolio manager at Fidelity Investments. He joined the company in 1966 as an intern and worked his way up to become the manager of the Fidelity Magellan Fund in 1977. Under his leadership, the fund grew from $18 million to over $14 billion in assets and became the largest mutual fund in the world.

Lynch retired from Fidelity in 1990 and has since been involved in a variety of philanthropic and educational activities. He is the vice chairman of the board of trustees of Boston College and serves on the boards of several other organizations. He is also a frequent speaker on the topics of investing and business. He is estimated to be worth around $500 million.

Peter Lynch Early Life

Peter Lynch was born in a middle-class family. His father was a vice president at an investment firm, which inspired Lynch’s interest in finance from an early age. Lynch was the oldest of three children and grew up in a modest home in the Boston suburb of Newton.

Peter Lynch attended Boston College, where he earned his undergraduate degree in economics in 1965. He went on to earn his MBA from the Wharton School at the University of Pennsylvania in 1968.

After completing his education, Peter Lynch began his career as a research analyst at Fidelity Investments in 1969. He quickly gained recognition for his ability to identify undervalued stocks and was promoted to the head of research in 1974. In 1977, Lynch was named the manager of the Fidelity Magellan Fund, which was a relatively small mutual fund at the time. Under his leadership, the fund grew from $18 million to over $14 billion, and Lynch became one of the most successful mutual fund managers in history. He managed the fund until 1990 after which he retired.

Throughout his career, Peter Lynch was known for his ability to find great investment opportunities by observing the world around him and looking for companies that had strong growth potential. He was a proponent of “bottom-up” investing, which involved studying individual companies rather than macroeconomic trends.

His early life and career set the stage for his success as an investor and author. His early exposure to finance, combined with his education and experience, helped him develop a unique approach to investing that focused on finding opportunities where others might not see them.

Peter Lynch Investment Strategy

Peter Lynch was known for his investment strategy, which emphasized a bottom-up approach to investing. He focused on identifying good companies with strong fundamentals and a competitive edge in their industry, rather than trying to predict macroeconomic trends. He was also known for his emphasis on thorough research and a deep understanding of the companies he invested in.

During his career, Peter Lynch received numerous accolades for his work as an investor, including being named “Portfolio Manager of the Decade” by Morningstar and “Money Manager of the Year” by several publications. He retired from Fidelity in 1990 at the age of 46 and went on to pursue philanthropic activities and write several books on investing.

His professional career was marked by his success as an investor and his contributions to the field of finance through his investment philosophy and writings. His achievements have made him a legend in the investment community and a role model for aspiring investors.

Peter Lynch Books

Peter Lynch has written several books on investing. Here are some of his most well-known books:

• One Up on Wall Street – This book is a classic on investing in the stock market and provides a practical approach to investing in individual stocks.

• Beating the Street – In this book, Lynch shares his experiences and strategies for investing in mutual funds and provides insights into how he managed the Fidelity Magellan Fund.

• Learn to Earn – This book is written for beginners and explains the basics of investing, including the stock market, bonds, mutual funds, and more.

• The New York Times Business Bestsellers: The Essential Peter Lynch Collection – This collection includes all three of Lynch’s books and provides a comprehensive guide to his investment philosophy and strategies.

• More Than You Know – In this book, Lynch shares his thoughts on investing, economics, and business, and provides insights into how he approaches investment decisions.

Peter’s books are highly regarded among investors and provide valuable insights into his investment strategies and philosophy. His books are written in an accessible and practical style that makes them easy to understand for novice investors, but also provide valuable insights for experienced investors looking to improve their investment performance.

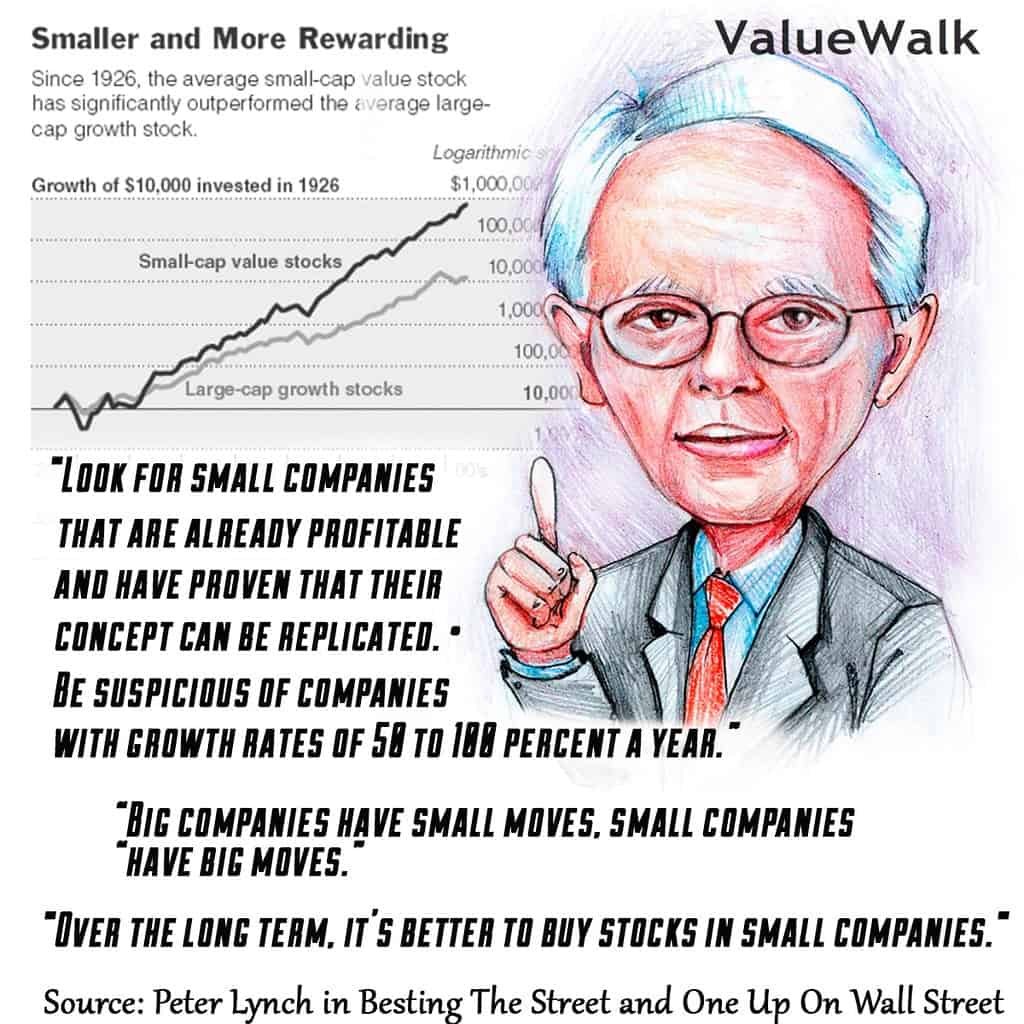

Peter Lynch Quotes

Peter Lynch is known for his wit and wisdom when it comes to investing. Here are some of his most famous quotes:

• In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.

• The best investment you can make is in your own abilities. Anything you can do to develop your own abilities or business is likely to be more productive.

• The stock market is a device for transferring money from the impatient to the patient.

• If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.

• The person that turns over the most rocks wins the game.

• You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.

• Know what you own and know why you own it.

• The problem with stock market bubbles is that they are so difficult to recognize while they’re happening.

• The simpler it is, the better I like it.

• Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it.

Peter Lynch’s quotes provide valuable insights into his investment philosophy and offer practical advice for investors looking to improve their investment performance.

Key Takeaways/Summary of the book ‘One Up on Wall Street’

One Up on Wall Street was first published in 1989. The book is a guide to investing in the stock market and shares the author’s experience and insights gained from his long career as a successful mutual fund manager. In this book, Lynch provides a detailed and practical approach to stock market investing that can be easily understood by novice investors. Here’s a summary of the key points discussed in the book:

• Invest in what you know: Lynch emphasizes the importance of investing in companies that you understand and have knowledge of, such as the products or services they offer.

• Look for growth opportunities: The author believes that the best companies are those that have strong growth prospects and are leaders in their industries.

• Invest for the long term: Lynch recommends holding onto stocks for the long term and not getting caught up in short-term market fluctuations.

• Be patient: Lynch stresses the importance of patience in investing and encourages investors to take a long-term view.

• Avoid fads and trends: The author advises against investing in trendy or speculative stocks that lack real earnings potential.

• Look for undervalued stocks: Lynch suggests looking for stocks that are undervalued by the market and have the potential for growth.

• Diversify your portfolio: The author recommends diversifying your portfolio across different sectors and industries to minimize risk.

• Stay informed: Lynch emphasizes the importance of staying informed about the companies you invest in, including their financial performance, industry trends, and management team.

• Use common sense: The author encourages investors to use common sense and avoid complex investment strategies or financial instruments they do not understand.

• Don’t be afraid to sell: Finally, Lynch advises investors to sell stocks that no longer meet their investment criteria or have reached their maximum potential.

Overall, the key takeaway from “One Up on Wall Street” is that individual investors can be successful in the stock market by developing a long-term investment strategy, understanding the companies they invest in, and being patient and disciplined in their investment approach.

Read More:

Terry Smith, Investing for Growth Book Summary

John Bogle, The Little Book of Common Sense Investing Book Summary

Joel Greenblatt, The Little Book That Beats The Market Summary