In this article, we will discuss about Mark Minerveni Trading Strategy, Net Worth 2023. Mark Minerveni was born on January 22,1965, in Queens, New York. He is among the world’s most successful stock traders, a former US Investing Champion and is also the author of the best selling books ‘Trade like a Stock Market Wizard’, ‘Think and Trade like a Champion’ and ‘Mindset Secrets for Winning’. He has been trading the markets for almost 40 years now. He started trading the marketsfrom 1983, but like other exceptional traders struggled to make any money during his initial years. He mentions that he could not make any money till 1989. Post that he started making money and hit a purple patch in 90s when he multiplied his capital a staggering 330 times from 1995 – 1999. Mark also won the US investing championship in 1997 and got featured in Jack Schwager’s prestigious Stock Market Wizards book.He once again won the US investing championship in 2021 clocking a massive return of 335%.

The first thing you need to know about winning is simple: If you don’t have the right mindset, then your knowledge, practice, and even skills will be rendered ineffective when you need them most—in the real world.

– Mark Minerveni

Mark’s exceptional stock market journey is captured in this video posted on his official YouTube channel. His current net worth is estimated to be greater than USD 30 million.

People say “Winning isn’t everything.” Don’t kid yourself: Losing sucks! You show me a “good” loser, and I’ll show you someone who makes losing a habit.

– Mark Minerveni

Childhood and Early Life

Mark Minervini grew up in abject poverty, watching his mother struggle and worry constantly about making ends meet.His parents divorced when he was just 8 years old. His mother went on welfare, and when the food stamps ran out, they barely had enough to eat. Subsequently, she met Dennis, a man who dreamed of success and promised her a better future. One fine day,Mark stumbled upon a stack of books of Dennis, where he found the book Think and Grow Rich by Napoleon Hill. This was the start of turning point in Mark’s life and he started believing that he too could become rich and get all the worldly treasures which he always desired.

Mark’s father also had a big impact in his life. He passed away unexpectedly when Mark was 26 years of age.Mark recalls in his book the phone call he received at four in the morning: “Mark, your Dad just suffered a massive heart attack.” He was only 57. He never considered the possibility of him not being around. It was the most traumatic event of his life. He was absolutely crushed by his loss. His father was his rock in times of crisis.He helped Mark get over massive anxiety attacks that plagued him as a teenager.

Champions are not realistic. They are audacious dreamers who set big goals. They’re not worried about setting goals too high; they’re afraid of setting them too low.

– Mark Minerveni

Trading Strategy

Earlier, Mark was very secretive about his trading strategies and patterns that he trades. He had refused to share any details about his trading patterns even in his interview with Jack Schwager for the Stock Market Wizards book. However, Mark eventually published his book ‘Trade Like a Stock Market Wizard in 2013 where he has in detail explained about his trading patterns.

Mark follows a template he calls as the ‘SEPA Strategy’ (SEPA stands for Specific Entry Point Analysis) The Five Key Elements of SEPA are Trend, Fundamentals, Catalyst, Entry and Exit Points.

The basic characteristics are broken down into five major categories, which make up the key foundational building blocks of the SEPA methodology:

• Trend- Stock should be in a definite price uptrend

• Fundamentals- There should be improvement in earnings, revenue, and margins

• Catalyst- A new product or service that the company has introduced or improving market share compared to competitors

• Entry Points- Most super performance stocks give at least one opportunity and sometimes multiple opportunities to catch a meteoric rise at a low-risk entry point. Timing the entry point is critical.

• Exit Points- Not all stocks that display super performance characteristics result in gains. Many will not work out even if entry is at the correct point for which loss needs to be taken quickly to protect the trading account. Also, winners need to be sold at some point to realize profits.

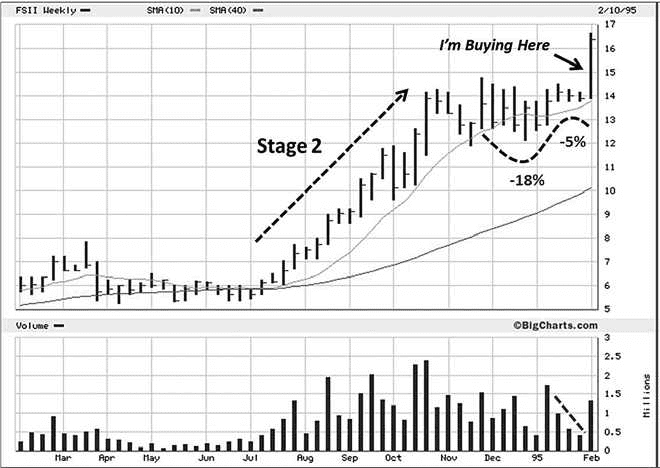

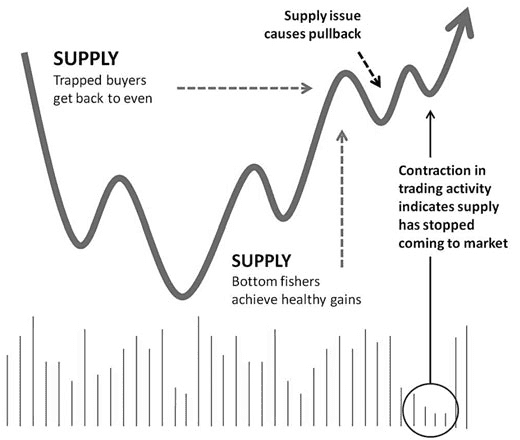

Mark times his entry when he observes a chart pattern that shows Volatility contraction pattern (VCP). He mentions in his book that the common characteristic of virtually all constructive price structures (those under accumulation) is a contraction of volatility accompanied by specific areas in the base structure where volume contracts significantly. Some of those signature chart structures are as below:

VCP is part of the supply and demand setup. The main role that VCP plays is establishing a precise entry point

at the line of least resistance. In virtually all the chart patterns that Mark trades, he is essentially looking for

volatility to contract from left to right. He mentions in his book that he want to see the stock move from

greater volatility on the left side of the price base to lesser volatility on the right side.

Those who succeed big at anything all have the same attitude: They keep going until it happens or die trying.Quitting is simply not an option. Super-successful people all share this level of commitment.

– Mark Minerveni

Personal Life and Hobbies

Mark is extremely private about his personal life. However, he has mentioned that he is married and has a daughter. Other details about his personal life and relationships are not known. His hobbies include drumming and pistol shooting. He also loves teaching trading and sharing his wisdom in a closed trade room with his members. More details about the same can be found here https://www.minervini.com/home.php

Thanks for reading.

Read More: