Anna Coulling is a financial market trader and educator who has authored several books on trading and investing. She has over 20 years of experience in the financial markets and is considered an expert in the field of technical analysis. Anna Coulling has also written several books on trading, including “A Complete Guide to Volume Price Analysis,” “Forex For Beginners,” and “Binary Options Unmasked.” Her books cover topics such as market analysis, risk management, and trading psychology.

In addition to writing books, Anna Coulling also provides online courses and webinars to help traders improve their skills and knowledge. Anna is also a regular commentator on financial markets, providing analysis and insights on news outlets such as CNBC and Bloomberg.

Anna Coulling’s approach to trading emphasizes the use of volume and price analysis to identify market trends and make informed trading decisions. She is a proponent of using technical analysis as part of a comprehensive trading strategy that includes risk management and a disciplined approach to trading. As per unofficial sources, Anna Coulling is estimated to be worth around $25 million.

Anna Coulling’s Professional Career

Anna Coulling began her career as a financial analyst in London in the late 1990s, where she gained experience in trading equities and derivatives. In 2004, she became a full-time trader and began developing her own trading strategies. After several years of successful trading, Anna Coulling began teaching others how to trade and invest in the financial markets. She published her first book, “Forex For Beginners,” in 2013, which quickly became a best-seller in the trading and investing genre. Since then, she has published several other books, including “A Complete Guide to Volume Price Analysis,” which has become a popular resource among traders.

In addition to writing books, Anna Coulling provides online courses and webinars to help traders improve their skills and knowledge. She also runs a website, AnnaCoulling.com, where she shares her market insights and analysis with her readers and followers. Anna has been featured as a financial commentator on various news outlets, including CNBC and Bloomberg. Anna is known for her expertise in technical analysis and her ability to simplify complex trading concepts for beginners and experienced traders alike.

Anna Coulling’s Personal Life

Anna has been a private individual who does not share much about her personal life in the public domain. She is originally from the United Kingdom and has lived and worked in London for many years. Anna has mentioned in interviews that she is passionate about trading and investing and that she spends most of her time researching and analyzing financial markets. Anna is also an advocate for sustainable living and has spoken about the importance of reducing our carbon footprint and protecting the environment. She is involved with various organizations and initiatives that support sustainable living practices.

Must Read: Terry Smith, Investing for Growth Book Summary

A Complete Guide to Volume Price Analysis book summary

A Complete Guide to Volume Price Analysis by Anna Coulling is a comprehensive guide to using volume and price analysis in trading and investing. The book is written for traders of all levels, from beginners to experienced professionals.

The book begins by introducing the basic concepts of volume and price analysis and how they can be used to identify trends in the financial markets. Coulling explains how volume can be used to confirm or contradict price movements, and how to interpret volume data to identify buying and selling pressure in the market.The book then goes on to cover various technical indicators, including moving averages, trend lines, and support and resistance levels. Coulling explains how these indicators can be used in conjunction with volume and price analysis to make informed trading decisions.

The second part of the book focuses on practical applications of volume and price analysis in different markets, including stocks, forex, and commodities. Anna Coulling provides real-world examples of how volume and price analysis can be used to identify trading opportunities and manage risk. Throughout the book, Anna emphasizes the importance of risk management and discipline in trading, and provides practical tips for developing a trading strategy that is both profitable and sustainable.

A detailed summary of the complete book is mentioned below:

• There are only two leading indicators in trading. One is price, the other is volume. In isolation, they are weak and reveal little, but put them together, and just like gunpowder, they become an explosive combination.

• Stocks generally go through phases of accumulation, mark-up, distribution, and mark-down.

• Retail Investors generally enter during the distribution phase, terrified that they were missing out on a golden opportunity only to see the price plunge shortly afterwards

• When demand is greater than supply, then prices will rise to meet this demand, and conversely when supply is greater than demand then prices will fall, with the over-supply being absorbed as a result.

• Volume reveals activity. Volume reveals the truth behind the price action. Volume validates price.• In order to employ ever increasing financial resources, specialists often effect price declines of ever-increasing dimensions in order to shake out enough stock

• Advances will have to be more dramatic on the upside to attract public interest in order to distribute the ever-increasing accumulated inventories.

• Market makers are wholesalers, nothing more, nothing less.

• Volume is far from perfect. The market makers have even learnt over the decades how to avoid reporting large movements in stock, which are often reported in after-hours trading

• If the market is bullish and the futures price is rising on strong and rising volume, then this is instantly telling us that the price action is being validated by the associated volume. The major operators are buying into the move. Equally, if the market is falling and the volume is rising, then once again volume is validating price. Volume without price is meaningless.

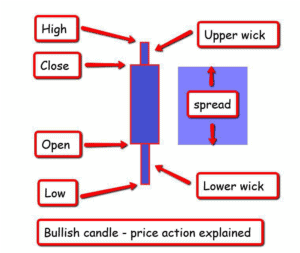

• Strong sentiment is confirmed when prices move sharply and spread expands with corresponding jump in volumes. Below picture, depicts the same

- Market, which is bullish, and has risen strongly in the trading session closing just below the high of the session. If this is a valid move then we would expect to see the effort required to push the market higher, reflected in the volume. This is also Wyckoff’s third law of effort vs. result. It takes effort for the market to rise and also takes effort for the market to fall, so if there has been a large change in price in the session, then we expect to see this validated by a well above average volume bar which we have. Therefore, in this case the volume validates the price. And from this we can assume two things. First, that the price move is genuine, and has not been manipulated by the market makers, and second, that for the time being, the market is bullish, and until we see an anomaly signaled, then we can continue to maintain any long position that we may have in the market.

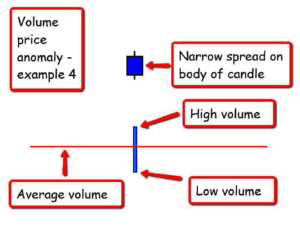

- Narrow Spread Candle and Low Volumes is a clear signal of a potential trap. The move higher is NOT a genuine move but a fake move, designed to suck traders into weak positions, and also take out stops, before reversing sharply and moving in the opposite direction

- Missing an opportunity’ is a classic trader (and investor) fear. The trader waits and waits before finally jumping in, just at the point when the market is turning, and they should be thinking of getting out. This is what the insiders, specialists, market markers bank on, trader fear.

- Five concepts lie at the heart of Volume Price analysis which are:

- Accumulation

- Distribution

- Testing Supply/Demand

- Selling Climax

- Buying Climax

- Accumulation phase is the period that the insiders go through to fill up their warehouse, prior to launching a major marketing campaign on selling their stock. So, accumulation is buying by the insiders, and depending on which market we are considering, can go on for weeks or months, depending on the instrument being acquired.

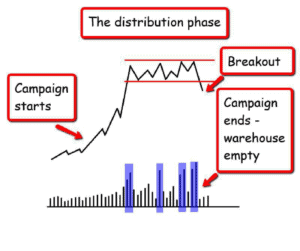

- The distribution phase is the exact opposite of the accumulation phase. In the accumulation phase, the insiders were filling their warehouses, in preparation for the next phase of the operation, in distribution phase they are emptying their warehouses.

- Testing Supply is one of the biggest problems the insiders face when mounting any campaign is they can never be sure that all the selling has been absorbed, following an accumulation phase. The worst thing that could happen is they begin to move the market higher, only to be hit by waves of selling, a of selling which would drive the market lower, undoing all the hard work of shaking the sellers out of the market. How do the insiders overcome this problem? And the answer is that just as in any other market, they test! Exact opposite happens for Testing Demand.

- Selling climax is the phase where sole objective is to get investors buy in the distribution phase, and buying climax is the exact opposite, to get investors sell in the accumulation phase. A buying climax is when the insiders are buying during the accumulation phase. The selling climax is the ‘last hurrah’ before the insiders take the market lower. It is the culmination of all their efforts, and is the point at which the warehouse is almost empty and requires one last big effort to force the market higher.

Overall, Anna Coulling’s book is a valuable resource for anyone interested in using technical analysis to trade or invest in financial markets. The book provides a clear and concise introduction to volume and price analysis, and offers practical advice on how to apply these techniques in real-world trading scenarios.

Key Takeaways:

Some key takeaways from the book are as below:

- Volume is an essential component of price analysis: Volume can be used to confirm or contradict price movements, and can help traders identify buying and selling pressure in the market.

- Technical indicators can be used in conjunction with volume and price analysis: Moving averages, trend lines, and support and resistance levels can all be used to identify trends in the market and make informed trading decisions.

- Risk management is crucial for long-term success: Traders should always have a plan in place for managing risk, including setting stop-loss orders and position sizing.

- Discipline is key: Successful traders have a disciplined approach to trading, and do not let emotions or outside influences affect their decisions.

- The book provides practical examples: Throughout the book, Coulling provides real-world examples of how volume and price analysis can be used in different markets, making it easy for traders to apply the techniques to their own trading strategies.

- Overall, the book emphasizes the importance of a comprehensive and disciplined approach to trading, and provides traders with the tools and knowledge they need to make informed decisions and manage risk effectively.

Final Thoughts

A Complete Guide to Volume Price Analysis by Anna Coulling is a valuable resource for traders and investors who are interested in using technical analysis to identify trends and make informed trading decisions. The book provides a clear and concise introduction to volume and price analysis, and offers practical advice on how to apply these techniques in real-world trading scenarios.

One of the strengths of the book is its emphasis on risk management and discipline, which are critical components of a successful trading strategy. The book provides practical tips and strategies for managing risk, including setting stop-loss orders and position sizing, and emphasizes the importance of maintaining a disciplined approach to trading.

Overall, Anna Coulling’s book is a well-written and informative book that provides traders with the knowledge and tools they need to succeed in the financial markets. Whether one is a beginner or an experienced trader, the book is a valuable resource that can help a budding trader sharpen his trading skills and achieve long-term success.

Read More: