Marty Schwartz is a renowned trader who has made a name for himself in the trading world. He is also known as “The Pit Bull” due to his tenacity and aggressive trading style. In this article, we will explore his personal and professional life, career, as well as his book “Pit Bull: Lessons from Wall Street’s Champion Day Trader.”

Personal Life

Marty Schwartz was born in New York City in 1964. He grew up in a middle-class family in New Jersey, where he attended high school. After high school, he attended Rutgers University, where he earned a degree in economics. Schwartz was always interested in the stock market and started trading when he was in college.

Professional Life

Marty Schwartz began his professional trading career in the early 1980s when he started working for E.F. Hutton. He then went on to work for various trading firms, including Commodities Corporation, where he met Paul Tudor Jones, a well-known trader. Jones became Schwartz’s mentor and taught him the art of trading.

In 1984, Marty Schwartz started his own trading firm, which he named “St. Croix Trading.” He traded commodities, stocks, and currencies and became one of the most successful traders of his time. He was known for his aggressive trading style and his ability to make quick decisions under pressure.

Career

Marty Schwartz’s career as a trader has been nothing short of impressive. He was able to turn a small trading account of $40,000 into $20 million in just ten years. He won the U.S. Investing Championship in 1984, where he turned $100,000 into $1 million in just one year. Schwartz was also featured in the book “Market Wizards” by Jack D. Schwager, which profiles successful traders.

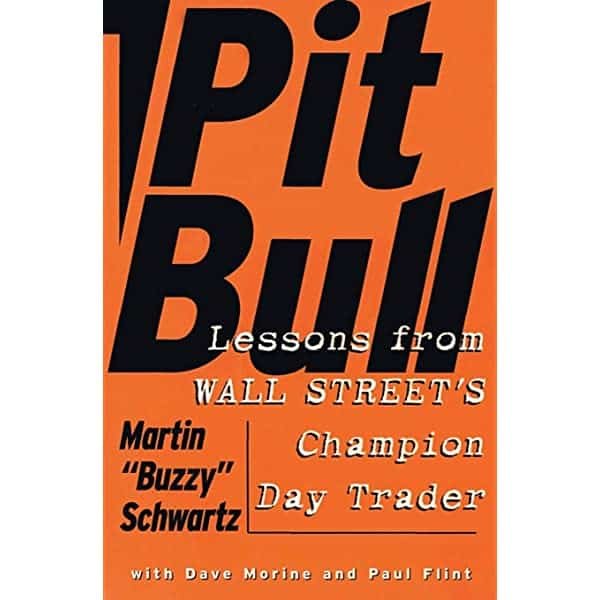

Pit Bull: Lessons from Wall Street’s Champion Day Trader Book Summary

In his book “Pit Bull: Lessons from Wall Street’s Champion Day Trader,” Schwartz shares his insights and experiences as a trader. The book is a memoir of his life and career as a trader and is divided into three parts.

“Pit Bull: Lessons from Wall Street’s Champion Day Trader” is a book written by Marty Schwartz, a renowned trader who made a name for himself in the trading world. The book is a memoir of his life and career as a trader, and it provides valuable insights and lessons that traders can learn from. Here is a detailed summary of the book:

Part 1: The Early Years

In this part of the book, Marty Schwartz talks about his childhood and how he got interested in the stock market. He also discusses his early trading experiences and the lessons he learned. Schwartz grew up in a middle-class family in New Jersey, and he attended Rutgers University, where he earned a degree in economics. He started trading when he was in college and was immediately hooked. He talks about his early successes and failures and the lessons he learned along the way.

Part 2: The Trading Years

In this part of the book, Marty Schwartz talks about his trading career and the strategies he used to become successful. He discusses his trading philosophy and the importance of risk management. He also shares some of his most successful trades and the strategies he used to execute them. Schwartz is known for his aggressive trading style, and he talks about how he was able to stay disciplined and manage risk while still making significant profits.

Part 3: The Lessons Learned

In this part of the book, Marty Schwartz shares the lessons he learned from his trading experiences. He talks about the importance of discipline, patience, and having a trading plan. He also discusses the importance of being able to adapt to changing market conditions. He shares some of the biggest mistakes he made in his trading career and the lessons he learned from them. He emphasizes the importance of learning from your mistakes and not repeating them.

The book also includes a section on technical analysis, where Schwartz talks about the importance of using charts and technical indicators to identify trading opportunities. He shares some of his favorite indicators and how he used them to make profitable trades.

One of the key takeaways from the book is the importance of risk management. Marty Schwartz emphasizes the importance of managing risk and limiting losses. He says that traders should always have a stop-loss order in place and that they should never risk more than they can afford to lose.

Another important lesson from the book is the importance of discipline. Marty Schwartz talks about the importance of having a trading plan and sticking to it. He says that successful traders don’t deviate from their plan and that they remain disciplined even in the face of losses.

Overall, “Pit Bull: Lessons from Wall Street’s Champion Day Trader” is a valuable book for anyone interested in trading. Marty Schwartz shares his insights and experiences as a trader and provides valuable lessons that traders can learn from. His success as a trader is a testament to the importance of discipline, risk management, patience, and adaptability in trading.

Key Takeaways

The book “Pit Bull: Lessons from Wall Street’s Champion Day Trader” provides valuable insights into the mind of a successful trader. Here are some key takeaways from the book:

- Discipline is key: Schwartz emphasizes the importance of discipline in trading. He says that successful traders have a plan and stick to it.

- Risk management is crucial: Schwartz talks about the importance of managing risk and limiting losses. He says that traders should always have a stop-loss order in place.

- Patience is a virtue: Schwartz emphasizes the importance of being patient and waiting for the right opportunities to arise. He says that successful traders don’t force trades but wait for the right setups.

- Adaptability is essential: Schwartz talks about the importance of being able to adapt to changing market conditions. He says that successful traders are always learning and adapting their strategies to stay ahead of the game.

Conclusion

Marty Schwartz is a legendary trader who has achieved remarkable success in his career. He is known for his aggressive trading style and his ability to make quick decisions under pressure. In his book “Pit Bull: Lessons from Wall Street’s Champion Day Trader,” he shares his experiences and insights into the world of trading.

Marty Schwartz’s success as a trader can be attributed to his discipline, risk management, patience, and adaptability. These are all key qualities that any trader should have if they want to succeed in the markets. His book provides valuable lessons that traders can learn from and apply to their own trading strategies.

In addition to his book, Marty Schwartz also shares his knowledge and experiences through various trading seminars and courses. He continues to be an influential figure in the trading community and is highly respected for his achievements.

In conclusion, Marty Schwartz is a trader who has left an indelible mark on the trading world. His book “Pit Bull: Lessons from Wall Street’s Champion Day Trader” provides valuable insights and lessons that traders can learn from. His success as a trader is a testament to the importance of discipline, risk management, patience, and adaptability in trading.